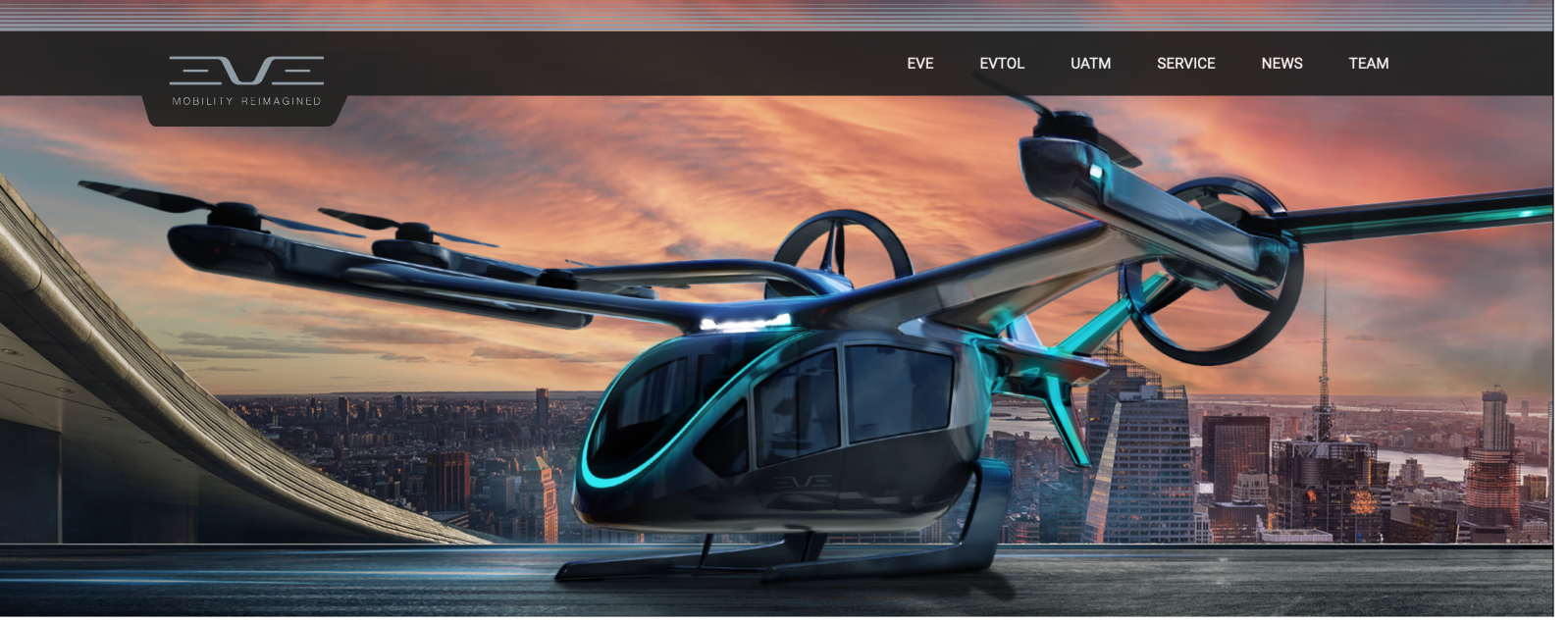

The end of 2021 is proving a busy time for Embraer’s urban air mobility unit (UAM) Eve, which in the space of a few hours announced the securing of two major electric vertical takeoff and landing (eVTOL) aircraft orders, as well as its plans to join the rising number of sector companies introducing their stocks on Wall Street.

Created in 2000 as a fully independent company leading the Embraer group’s charge into UAM transportation, Eve revealed its flurry of big news this week as most other US businesses started winding down for minimal action heading into the holiday season. First the company announced a pair of deals to deliver a total of 300 eVTOL planes to two separate air transport clients. It followed that up with word of its plans to list its shares on the New York Stock Exchange via a Special Purpose Acquisition Company (SPAC) – an operation that should value it at $2.4 billion.

When that transaction is closed at a yet unspecified date, Embraer is expected to retain an 82% equity stake in the new Eve Holding company, which is expected to be left with $512 million in cash issuing from the deal’s total pro forma equity value of about $2.9 billion.

As virtually always with SPAC flotation schemes, the objective is to get through the introduction process faster, and with less administrative and regulation toil than traditional stock market methods. And as was the case with sector rivals like Joby, Lilium, Archer, and Vertical, Eve’s logic for heading to Wall Street along the SPAC path is to raise as much UAM development money as possible to finance development of rapidly approaching eVTOL service launches.

“We believe that the urban air mobility market has enormous potential to expand in the coming years based on an efficient, zero-emissions transport proposition,” said Francisco Gomes Neto, president and CEO of Embraer. “With (that) business combination, Eve is very well positioned to become one of the major players in this segment.”

That view is also based on what Embraer says are $5.2 billion eVTOL aircraft orders on Eve’s books already. Those were increased further with the letters of intent Eve revealed this week signed by two air transport companies securing vehicles for UAM service. The first covers longtime Embraer leasing client Azzora, which has signed on for 200 aircraft. That was followed by regional airline SkyWest placing a bid for another 100 planes.

As part of that second transaction, Eve and SkyWest agreed to develop a range of services-based methods for analyzing and optimizing eVTOL performance in cities that move quickly to adopt UAM operations. That will involve the companies creating a joint team to focus on vehicle design, vertiport specifications, and certification procedures.

Eve meanwhile hailed the accord with Azzora as being a major inroad to third-party eVTOL and other UAM operators through the kind of aircraft leasing company that dominates ownership of fleets loaned to airlines for operation.

“Today almost half of the commercial aircraft are leased and we believe leasing companies will also play an active role in Urban Air Mobility, allowing operators to remain asset-light,” said Andre Stein, Eve co-CEO. “Azorra has a history of helping markets grow and we are excited to join them in this new frontier for aviation.”

FTC: We use income earning auto affiliate links. More.

Comments