Embraer’s urban air mobility (UAM) operation, Eve, has joined a growing number of next-generation aircraft companies going public using a relatively recent kind of stock market floatation procedure.

Shares of Eve began trading yesterday following an issue on the New York Stock Exchange that raised a total of $377 million. The introduction was made possible by Eve’s merger with Zanite, a special purpose acquisition company (SPAC) created specifically to enable an expedited process of going public – an innovation that has been repeatedly used by startups in the past year. Other UAM sector firms that have gone the same route include Lilium, Joby, Archer, and Vertical.

Read more: Joby joins drone-sector, SPAC-led push on Wall Street

Though regarded with some suspicion by market skeptics, SPACs allow relatively young companies to raise millions or billions in capital far faster than the arduous (and, critics say, more transparent) months of traditional road shows seeking to convince investors to put their money in stocks to be floated.

With the SPAC created as the vehicle through which shares are issued, all that’s required is approval by the startup’s relatively small pool of backers, after which tech-enamored funds and individual speculators can either take a stake in it, or pass. In some cases that involves backing a firm with futuristic vehicles or gadgets already nearing production, while others represent a bet on a promising sounding idea still taking shape.

Read more: Embraer eVTOL unit Eve reveals a rash of UAM developments

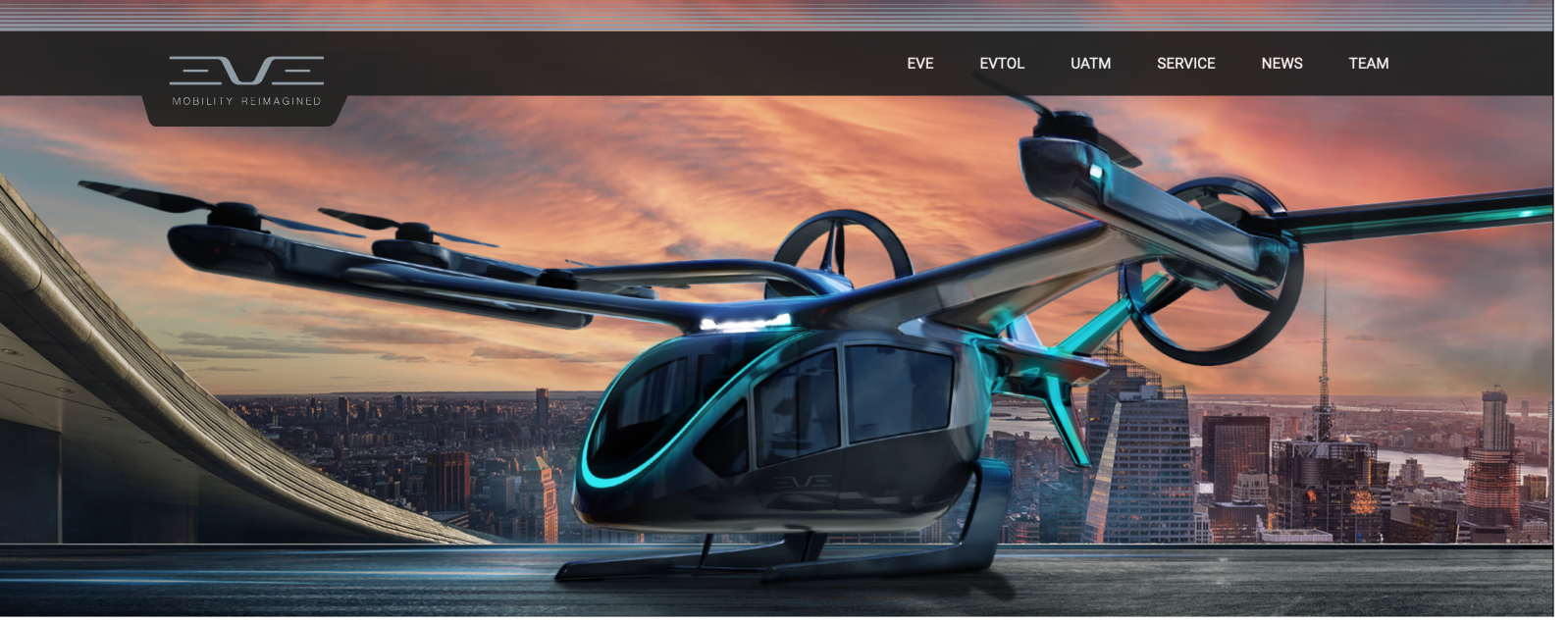

Eve’s case is somewhere in between those. The electric takeoff and landing planes it plans to fly in air taxi and longer UAM services have not yet been created as prototypes. But their development isn’t in doubt either, given aircraft giant Embraer’s support of and enthusiasm with next-generation travel.

Yesterday’s floatation represented both companies moving to let other believers get in on that future.

“Today, we celebrate a historic milestone in a journey that we began nearly five years ago in EmbraerX, the market accelerator of Embraer, a leader in the global aviation industry,” said André Stein, Eve co-CEO. “This transaction is a key enabler of our mission to become a leading player in a potential $760 billion UAM addressable market.”

Under Embraer’s wing, Eve benefits from a royalty-free license to use the aviation company’s background intellectual property in UAM markets. It can also turn to thousands of skilled Embraer staffers and other resources in its work developing next-generation planes. Eve’s strategic alignment with Embraer also affords it significant cost and operational advantages as it endeavors to scale its UAM craft and services around the globe.

Read more: Eve Mobility creates consortium, sells eVTOL craft for Miami UAM development

“We believe in the great potential of the global UAM market, and Eve is well positioned to be a global leader by delivering an effective and sustainable new mode of urban transportation”, said Francisco Gomes Neto, president and CEO of Embraer. “We are fully committed to Eve, which plays a key role in our growth strategy driven by innovation and enterprise efficiency.”

FTC: We use income earning auto affiliate links. More.

Comments