Drone insurance company SkyWatch.AI has been providing flexible insurance coverage to thousands of commercial drone pilots in the United States since 2018. This month, the company decided to take a deep dive into its policy data to date and dig out drone industry trends. Here’s what they found out…

Autel, Skydio emerging as DJI competitors

DJI has continued to dominate the commercial drone market since 2018. But between then and now, the company has lost 7% of its market share from SkyWatch customers. In 2018, more than 94% of all commercial drone pilots using the SkyWatch platform were insuring DJI drones. Today, at the end of the first half of 2021, that number has dipped to 87%.

Read more: No, DJI’s sub-250-gram, sub-$300 Mini SE is not coming to US

Drone manufacturers Autel and Skydio have emerged as the biggest competitors to DJI in this time period. Autel, with its acclaimed EVO I and EVO II drones, has risen its market share from under 1% in 2018 to more than 5% in 2021. Skydio, meanwhile, has become the commercial drone provider of choice for 1.5% of SkyWatch customers in 2021.

Dozens of other companies with unique products and capabilities have also boosted their share of the market, SkyWatch data reveals.

Drone industry trend: Increasing equipment prices

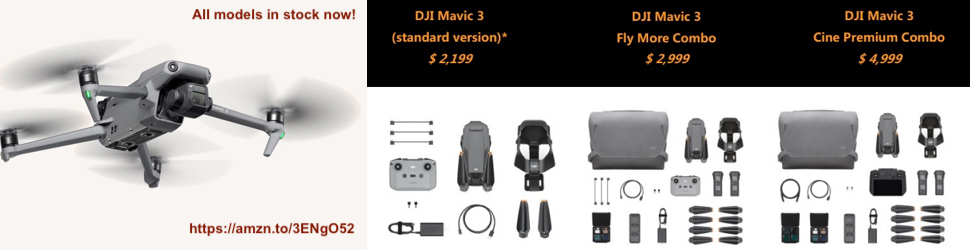

Another interesting drone industry trend has come to fore from an analysis of SkyWatch data: The average prices of commercially insured drones and equipment are rising.

Today, the average price of a drone being insured on the SkyWatch platform is $2,903.76, which is a 22% increase from the 2018 average.

As Ilan Yusim, head of marketing at SkyWatch.AI, explains in a blog post:

With market share becoming diversified, more companies fight for their spot with newer and feature-packed drones year over year. With newer drones, businesses are willing to spend more on their drones for more advanced features and technology, hence the rising prices.

Also read: Parrot Anafi Ai drone’s 4G connectivity feature: innovation or marketing stunt?

Commercial drone usage has expanded exponentially ever since the FAA issued its first drone commercial permit in 2006. The trends laid bare by the SkyWatch data analysis prove that the drone manufacturing industry is indeed maturing. It would be interesting to note what other trends take shape next. We’ll keep you posted!

FTC: We use income earning auto affiliate links. More.

Comments