All startups developing next generation air taxis and longer distance advanced air mobility (AAM) aircraft face a wide range of technical, engineering, and production challenges as they guide planes toward certification, but German company Liliumnow finds itself wrestling with increasingly tight financial reserves that better funded rivals do not.

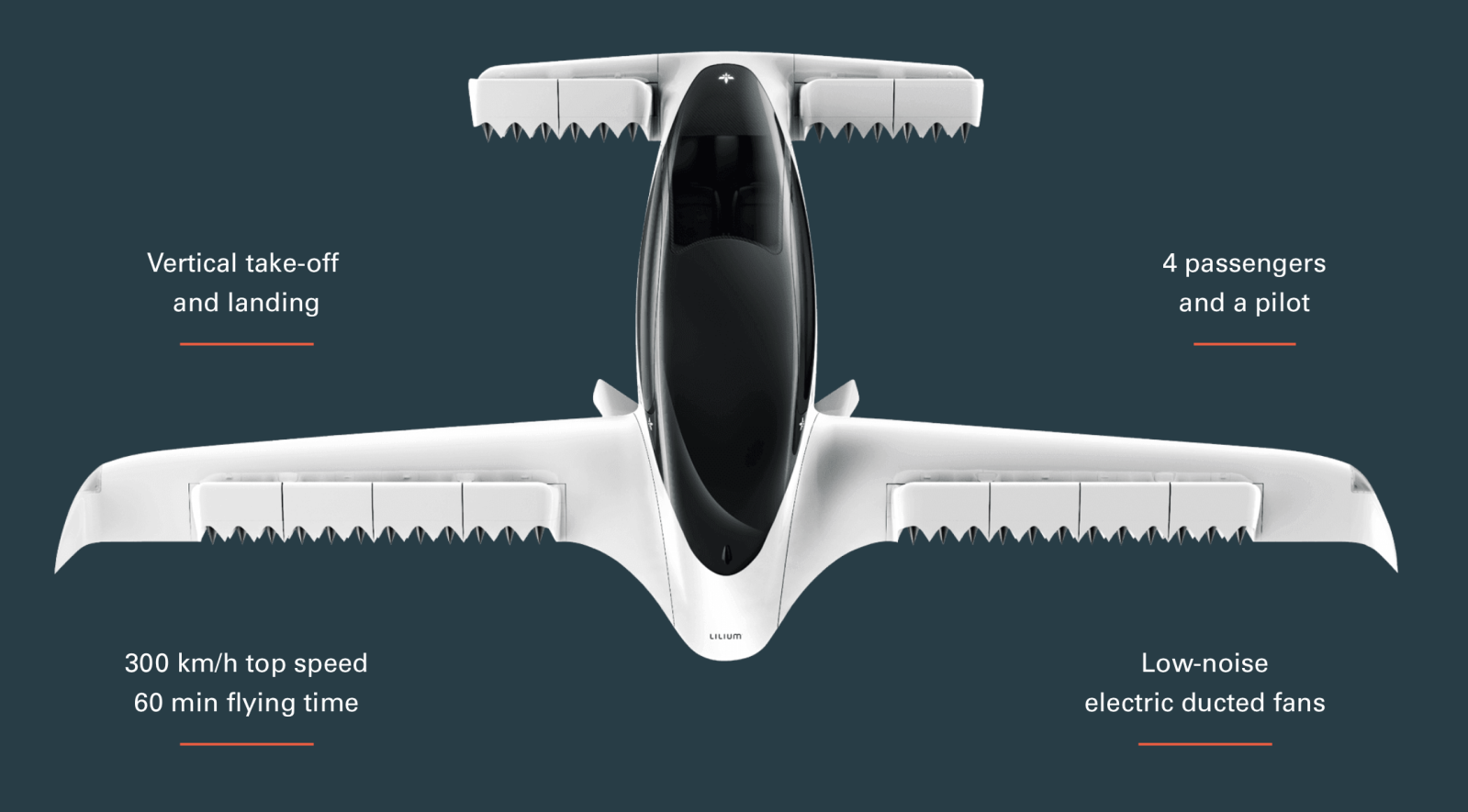

Lilium has always been something of an outlier in the AAM sector with its wing-incorporated rotors and vectored-thrust design that eschews the drone-like exposed blades of most air taxi developers. Its plans also seek to produce craft capable of flying beyond the relatively contained urban limits of rival makers to operate longer commercial routes, while also marketing its electric-powered jets to well-heeled private users.

But even in an AAM tech and transport activity that defines entirely new parameters for itself as it matures, Lilium’s unorthodox approach is creating difficulties that may complicate its drive to put a certified air taxi into operation by 2025.

Read: Saudia eVTOL accord gives Lilium a strategic MENA foothold

Up until now that aspect of that that has gained the most attention has been the larger and more powerful batteries Lilium craft need to fly. Those cells have proven sufficiently expensive to create and produce that some outside experts have warned they’d never be viable in pure cost terms.

Consequently, they’ve been a big reason for why the company has been spending increasingly large amounts of its cash reserves, which have in turn fallen to what some Wall Street analysts now call dangerously low levels.

Indeed, Lilium itself has said in a recent report to investors that it is in “active and constructive constructive discussions on follow-up funding” with private investors about new infusions. It is also exploring possibilities to qualify for German and European government grants to businesses developing next generation tech.

But while the company has managed to attract additional financing since its 2021 NASDAQ flotation – recruiting $119 million last November alone – it will need to be at the top of its game to secure new funding.

Lilium said it finished 2022 debt-free with reserves of €206 million ($225 million), However, according to specialized stock market publication Simply Wall St., the company spent €267 million last year. That so-called “cash burn” rate relative to revenues that will require new financing rather fast – especially with Lilium, like mostAAM startups, report zero income that isn’t linked to future deliveries on air taxi sales accords.

That pace of outflows, the site said, meant that the end of 2022 Lilium’s cash reserves were scheduled to run out in August. And if that tightening pinch doesn’t leave Lilium a huge amount of time to generate investment, other factors won’t simplify that task either.

Read: Lilium’s annual 400 eVTOL air taxi production goal seeks new funding

Over the past year the company’s stock has tumbled by 89% of its previous value. That has repeatedly involves share prices to sink below that $1 level, which – if prolonged – could lead to its delisting by NASDAQ. That won’t facilitate convincing new and existing investors to provide additional funding, yet with higher interest rates making debt options even more expensive, seeking renewed outside support is Lilium’s best strategy.

To be sure, there are other air taxi developers facing similar financial tensions, leading some observers to expect a significant shake-out of the increasingly crowded AAM market overall before too very long. Lilium at least has the advantage of being one of the more mature players in that pack, and is a lot farther along in production, testing, and potential certification than most.

But with outside analysts already expecting Lilium to spend somewhere between $250 million and $280 million this year – and with the company itself saying it needs new infusions to guide its air taxi through the certification process – AAM observers are now just how much and how fast the Munich firm can come up with in new cash as the count-down to August advances.

FTC: We use income earning auto affiliate links. More.

Comments